2022/07/08

1025

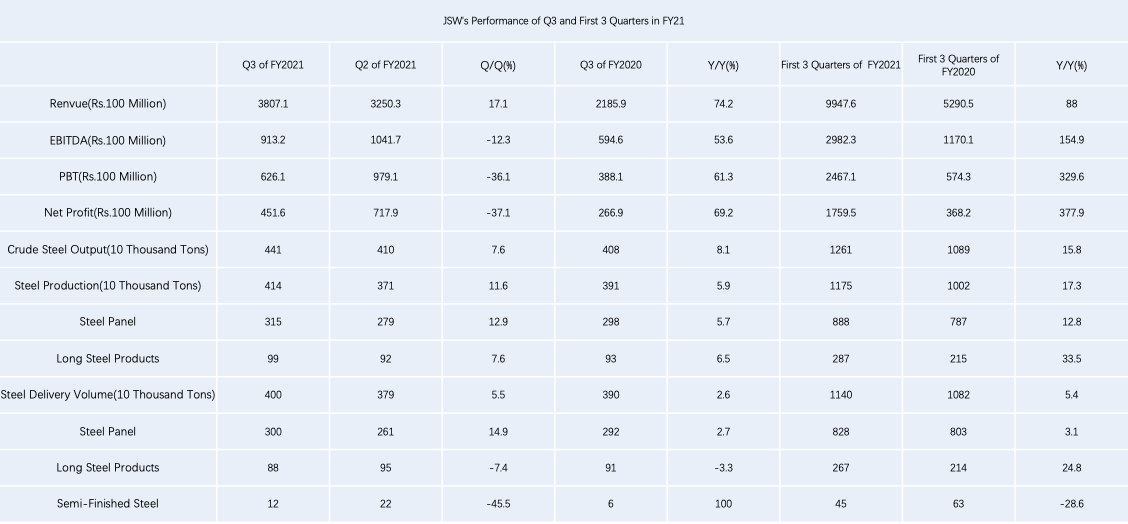

In the Q4 of 2021 (the Q3 of FY21), India's economy, industrial production and consumer spending rebounded significantly as the domestic epidemic subsided and lockdown restrictions were gradually lifted. The Indian government strengthened infrastructure construction and increased manufacturing investment to promote the country's steel demand growth, and the RBI also took positive measures to boost the economic recovery. At the same time, India's taxation departments took tax reduction measures to promote its commodity export. With the supply difficulty in semiconductor chips for automobiles eased, India's automobile (especially new energy vehicles) output and sales revived.

Production and Sales in Q3 of FY21

As a result of these factors, the average utilization rate of the crude steel capacity of JSW Steel further increased to 94% in the FQ3 from 91% in Q2 of FY21. Crude steel output increased by 7.6% QoQ to 4.41 million tons from 4.1 million tons in FQ2 and also increased by 8.1% compared with 4.08 million tons in Q3 of FY20.Steel production increased sharply by 11.6% QoQ to 4.14 million tons from 3.71 million tons in FQ2 and also increased by 5.9% compared with 3.91 million tons in Q3 of FY20.

In FQ3, JSW's steel delivery quantity rose by 5.5% Q/Q to 4 million tons from 3.79 million tons in FQ2 and also increased slightly by 2.6% compared with 3.9 million tons in the third quarter of fiscal year 2020.

Benefiting from higher domestic steel demand in India after the rainy season, JSW's domestic steel sales was significantly up by 30.8% QoQ to 3.1 million tons in FQ3 from 2.37 million tons of the last fiscal quarter, which means a substantial 10.9% drop compared with 3.48 million tons in Q3 FY2020. The proportion of steel domestic sales rose notably to 79% from 62% of the June financial quarter, but was lower than 88% in the third quarter of FY2020 while steel exports share fell back to 21% from 38% in the last quarter, but was well above the 12% in the third quarter of FY20. In Q3, domestic auto sales in India increased slightly by 2.0% QoQ, but the production volume saw a big decline by 10% QoQ. Higher than 57% in Q3 of FY20, JSW's high value-added and special steel sales share of total steel sales volume went up to 62% from 60% of the second quarter benefiting from increased domestic demand for steel in the renewable energy, appliance and tinned sheet sectors.

Production and Sales in First 3 Quarters of FY21

In the first 3 quarters of FY21, JSW's crude steel production witnessed a sharp improvement by 15.8% year-on-year to the level of 12.61 million tons from 10.89 million tons in the first 3 quarters of FY20 and steel production saw an increase by 17.3% year-on-year to 11.75 million tons from 10.02 million tons in the first three quarters of last fiscal year.

The steel dispatched volume by JSW improved by 5.4% y/y to 11.4 million tons versus 10.82 million tons in the first three quarters of FY2020.

Q3 Results of FY21

Driven by a combination of higher steel deliveries and increased domestic steel sales share and upward steel prices in the Indian domestic market, JSW's revenue grew by 17.1% QoQ to Rs. 380.71 billion in FQ3 versus Rs. 325.03 billion of the last fiscal quarter, which was up 74.2% y/y compared with Rs. 218.59 billion. Effected by higher costs of coking coal, power and fuel, earnings before interest, taxes, depreciation and amortization (EBITDA) fell down by 12.3% QoQ from Rs. 104.17 billion in Q2 to Rs. 91.32 billion, but was a significant growth by 53.6% compared with Rs. 59.46 billion in Q3 FY20. Pre-tax profits declined considerably by 36.1% QoQ from Rs.97.91 billion of Q2 to Rs.62.61 billion, a significant increase of 61.3% compared with Rs. 38.81 billion in Q3 of FY20. Net profit shrank dramatically by 37.1% QoQ to Rs. 45.16 billion from Rs. 71.79 billion in FQ2, meaning a massive 69.2% Y/Y uplift compared with Rs. 26.69 billion.

Performance in First 3 Quarters of FY21

JSW's revenue in the first 3 quarters of FY21 reached Rs. 994.76 billion crores, a great leap by 88.0% YoY against Rs. 529.05 billion crores over the same period last year, benefiting from year-on-year growth in steel sales, increased share of steel domestic consumption and recovery in Indian domestic steel prices. EBITDA surged by 154.9% YoY to Rs. 298.23 billion from Rs. 117.01 billion. Profits before tax soared by 329.6% YoY to Rs. 246.71 billion from Rs. 57.43 billion and net profits jumped by 377.9% YoY from Rs. 36.82 billion in the first 3 quarters of FY2020 to Rs. 175.95 billion.

As a key partner of JSW, PKU Pioneer's supplied 6 sets of VPSA oxygen systems to JSW Steel in 2021, providing sufficient enriched oxygen for blast furnace ironmaking to improve the smelting efficiency and total output. In total, PKU Pioneer has offered the company 11 sets of VPSA oxygen plants with the total oxygen capacity reaching over 100,000Nm3/h. Up to now, PKU Pioneer has provided superior oxygen enrichment solutions for nearly 60 iron and steel enterprises around the world. By adopting oxygen injection before the blower process to improve the oxygen enrichment rate, we've managed to help the users achieve cost reduction & higher efficiency so as to lift the overall economic benefits.

(Data from World Metals)