1. Background

Due to India's heavy reliance on fossil fuels such as coal and oil, the Indian steel industry primarily uses coking coal for blast furnace ironmaking and non-coking coal for direct reduction and power generation. Oil is used both as fuel (for reheating) and for internal transportation. The CO2 emissions from the Indian steel industry account for about 12% of the country's total industrial emissions, making up approximately 7%-9% of the global total. Although the BF-BOF (Blast Furnace-Basic Oxygen Furnace) process accounts for less than 50% of India's total steel production, India's CO2 emission intensity is over 30% higher than the global average.

Carbon neutrality is one of the most pressing issues facing the world today. The Indian government has also put carbon neutrality on the agenda, proposing to achieve net-zero emissions by 2070. To achieve this goal, the Indian steel industry is taking measures to reduce emission intensity. Short-term options include reducing energy consumption in currently used processes and increasing the use of scrap steel. Carbon Capture, Utilization, and Storage (CCUS) is also an option, but it involves capital expenditure. The Indian Ministry of Steel aims for major steelmakers to increase the scrap ratio to 50% by 2050.

2. Production Situation of Indian Major Steelmakers

2.1 Steelmaking Processes

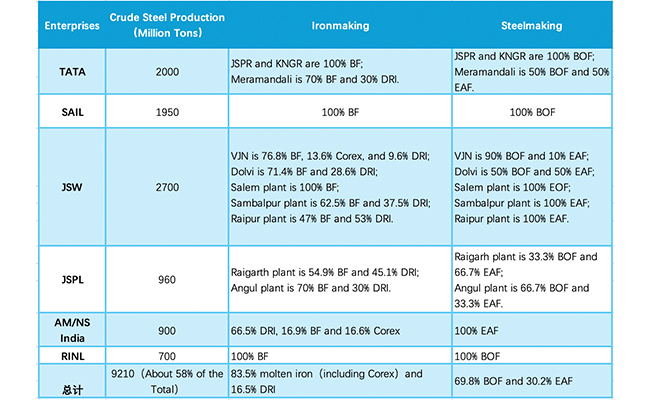

The current capacities and steelmaking processes of Indian major steel manufacturers are listed in Table 1 below. In the fiscal year 2023, the crude steel output of major manufacturers accounted for 60.7% of the total, with approximately 70% produced via the basic oxygen furnace (BOF) and the remaining 30% via electric arc furnace (EAF) production.

Table 1- Current Capacities and Steelmaking Processes of Indian Major Steel Manufacturers

2.2 Use of Iron Ore and Scrap Steel

In India, major steelmakers’ utilization of scrap steel remains below 10%, decreasing from 8.44% in the fiscal year 2022 to 7.27% in fiscal year 2023. Overall, despite an increase in imports, the share of scrap steel in total steel input declined from 22.76% in fiscal year 2022 to 21.16% in fiscal year 2023, primarily due to rising scrap steel prices. Domestic scrap steel consumption in fiscal year 2023 was 21.649 million tons, down from 27.837 million tons in fiscal year 2022.

The reduction in scrap steel usage is attributed to decreased domestic production, price increases, and limited availability of imported scrap steel. The Ministry of Steel in India notes that current levels of scrap steel usage do not meet government expectations for reducing carbon emissions. Approximately 60 countries have either banned or are in the process of banning scrap steel exports. While domestic scrap steel production in India may increase, it is unlikely to significantly reduce emissions. Due to insufficient scrap steel availability, Electric Arc Furnace (EAF) steel mills are compelled to use molten iron, accounting for over 40% total steel input, exceeding 42.2% in fiscal year 2022 and 43.2% in fiscal year 2023. Increased Direct Reduced Iron (DRI) usage (coal-based) does not contribute significantly to emission reduction.

The low proportion of scrap steel is one of the reasons for India's high emission intensity. Each ton of scrap steel can reduce CO2 emissions by 1.5 tons and save 1.4 tons of iron ore, 740 kilograms of coal, and 120 kilograms of limestone.

3. Expected Steel Production and Processes for 2030 and 2050

3.1 Steel Production

According to India's National Steel Policy released in 2017, the crude steel production in fiscal year 2031 is expected to reach 255 million tons. This necessitates a compound annual growth rate (CAGR) of 9.2% for crude steel production from fiscal year 2023 to fiscal year 2031.

According to forecasts by Crisil, India is expected to spend nearly 143 billion rupees on infrastructure development during the fiscal years 2024-2030, more than double the 670 billion rupees spent in the previous 7 fiscal years starting from 2017. Over the 15 fiscal years from 2016-2031, the average CAGR is projected at 7%; for the 15 fiscal years from 2008-2023, the actual CAGR was 5.8%; and for the 5 fiscal years from 2018-2023 (excluding the impacted fiscal year 2021), the CAGR was 7.2%. Therefore, given the Indian government's focus on infrastructure development, an estimated CAGR of 8% is anticipated for fiscal year 2031. Based on an 8% CAGR, the crude steel production in fiscal year 2031 is projected to reach 233.7 million tons. Considering various forecasts, India's crude steel production is estimated to be around 500 million tons by the year 2050.

3.2 Steel Processes

According to the National Steel Policy, by the fiscal year 2031, 60%-65% of crude steel production in India will be through the BF-BOF route, and 35%-40% will be through the DRI-EAF process. Given the current situation that India currently has 71 blast furnaces with 5 under construction, and an additional 22 new blast furnaces have been announced. Therefore, even by the year 2050, India is expected to have a significant BF-BOF production capacity, suggesting that blast furnaces will continue to play a crucial role.

4. Forecasted Availability of Scrap Steel in India for 2030 and 2050

Estimated scrap steel generation in India was approximately 280 million tons in fiscal year 2022 and around 220 million tons in fiscal year 2023. As a developing country, more than 60% of India's steel production is dedicated to infrastructure and construction sectors with lifespans of about 50 years, so the amount of generated scrap steel will not be substantial.

End-of-life vehicles are one of the sources of scrap steel. The Indian government implemented a vehicle scrappage policy in 2022, mandating passenger vehicles over 20 years old and commercial vehicles over 15 years old should be scrapped. It is estimated that scrap steel from scrapped vehicles will amount to 4.6 million tons in the fiscal year 2023, 5.3 million tons in the fiscal year 2025, and 7.3 million tons by 2030. By 2050, this number could rise to approximately 15 million tons.

Other sources of scrap steel include decommissioned ships, construction sites, factories, workshops, and internally generated scrap steel from steel plants. By 2030, shipbreaking could produce 7-7.5 million tons of scrap steel and internally generated scrap steel in steel plants accounts for about 8% of crude steel production. By 2030 and 2050, estimates suggest this source could generate approximately 200 million tons and 400 million tons of scrap steel, respectively.

Globally, it is estimated that crude steel production will reach 1.95 billion tons by 2030, with scrap steel consumption at 828 million tons, and a scrap steel utilization rate of 35%-36%. The BF to EAF ratio is expected to be 60:40, compared to the current ratio of 70:30.

5. Forecasted Steel Input Structure and Processes for FY 2030 and FY 2050

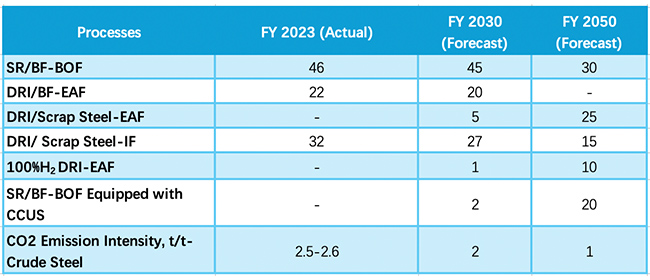

India's steel processes for fiscal year 2023 consist of 46% BF-BOF, 22% BF/DRI-EAF, and 32% IF (DRI and scrap). The usage rates of scrap steel in blast furnaces, electric arc furnaces, and induction furnaces are approximately 8%, 27%, and 30%, respectively; the rates of molten iron are 92%, 43%, and 0%, while that of DRI are 0%, 30%, and 70%. Of the DRI used in electric arc furnaces, about 85% is gas-based, and the remaining 15% is coal-based and Induction furnaces use 100% coal-based DRI. The molten iron includes production from smelting reduction furnaces.

When planning future processes, 2 key points are crucial: first, reducing the high proportion of BF-BOF to lower CO2 emissions; second, decreasing the proportion of induction furnaces to produce more high-end steel grades. It is recommended to adopt the processes shown in Table 2 below.

Table 2- Recommended Steel Processes (%)

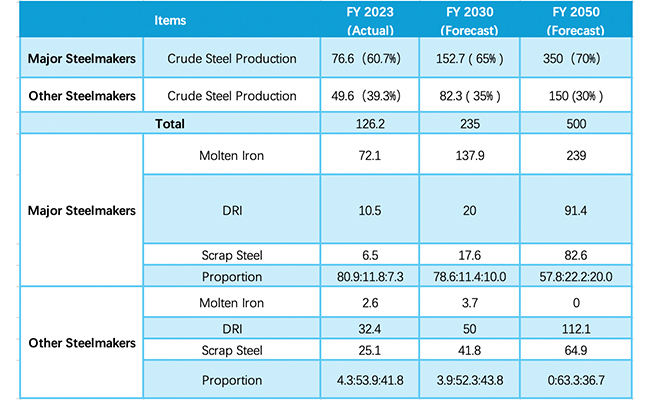

Table 3 lists the forecasted crude steel production, input requirements, and their proportions (molten iron: direct reduced iron: scrap steel) for major steel plants and other manufacturers in the fiscal years 2030 and 2050, along with actual data for FY 2023.

Table 3 - Forecasted Crude Steel Production, Input Requirements, and Proportions (Million Tons, %) for Indian Steelmakers

6. Conclusion

Currently, the CO2 emissions intensity of India's steel industry is 30% higher than the global average, facing a dual challenge of inadequate availability of scrap and natural gas. As a result, significant use of hot metal and coal-based Direct Reduced Iron (DRI) leads to high emissions intensity. Moreover, due to restrictions or bans on scrap exports by most countries to increase domestic scrap utilization, importing scrap is also extremely challenging.

It will be difficult to replace all blast furnaces by 2050, as some have been recently commissioned and others are still under construction. Therefore, increasing the scrap usage to 50% by 2050 is not feasible for major Indian steel mills.

It is projected that by 2050, the scrap ratio in India could reach 25% (currently about 20%), with major steelmakers achieving 20% (currently about 10%).

Traditional scrap steel production relies heavily on coal and coal-based DRI, leading to high carbon emissions. In contrast, EAF steelmaking uses electricity to heat scrap steel and iron, reducing the demand for coal and significantly lowering carbon emissions.

In short-process EAF steelmaking, the application of Vacuum Pressure Swing Adsorption (VPSA) oxygen units is crucial for improving furnace control and production efficiency. VPSA oxygen plants employ molecular sieves to generate enriched oxygen from air. Compared to traditional cryogenic systems, VPSA oxygen systems have lower construction and operating costs, and can adjust oxygen flowrate according to demand variations during steelmaking, which helps optimize furnace atmosphere and chemical reactions in the melt to further improve furnace operation efficiency and steel product quality and contribute to substantial reductions in energy consumption and emissions, thereby lowering the overall carbon footprint.

With 25 years of expertise in gas separation, PKU Pioneer leads internationally in VPSA oxygen production technology in terms of oxygen capacity, equipment performance, and energy efficiency. PKU Pioneer has provided high-quality oxygen generation solutions to over 70 steel enterprises worldwide, including leading global firms like Baosteel, helping the users optimize steelmaking processes, reduce energy consumption, and achieve green sustainable development.